Investing in real estate used to be reserved for the wealthy, requiring large amounts of capital and industry expertise. But with Groundfloor, the game has changed. Now, everyday investors can access short-term, high-yield real estate investments with as little as $10, making property-backed investments more accessible than ever before.

Groundfloor is an innovative platform that enables both accredited and non-accredited investors to participate in fractional real estate debt investments. Instead of purchasing entire properties, investors fund real estate loans, earning passive income while minimizing risk. With an average historical return of around 10% annually, Groundfloor provides a compelling opportunity to diversify portfolios and grow wealth through real estate—without the hassle of property management.

We’ve rounded up the best investment opportunities from Groundfloor that offer great returns, security, and flexibility. Whether you’re a first-time investor or an experienced pro, these picks will help you maximize earnings while minimizing risks.

A Quick Overview:

- Best Low-Risk Real Estate Investment – Limited Recourse Obligations (LROs)

- Best Automated Investment Portfolio – Flywheel Portfolio

- Best Short-Term Investment Option – Groundfloor Notes

- Best Tax-Advantaged Real Estate Investment – Groundfloor IRAs

- Best for Passive Income – Self-Directed Auto Investing

- Best Beginner-Friendly Investment – Minimum $10 Investments

How to Choose the Right Real Estate Investment with Groundfloor

Investing in real estate no longer requires large amounts of cash or experience, thanks to Groundfloor’s unique approach. But choosing the right investment strategy depends on your goals and risk tolerance. Are you looking for steady, passive income? Or are you interested in a hands-off approach to building wealth?

For investors who want control over their investments, Limited Recourse Obligations (LROs) allow you to handpick individual loans, offering flexibility and customization. If automation is your priority, the Flywheel Portfolio reinvests your earnings across multiple loans, ensuring consistent returns with minimal effort.

If you prefer low-risk and fixed returns, Groundfloor Notes offer short-term investments with guaranteed annualized returns, making them a great alternative to traditional bonds or savings accounts. Meanwhile, for tax benefits and retirement planning, Groundfloor IRAs allow investors to grow their money tax-free while earning real estate-backed returns.

No matter your investment style, Groundfloor makes it easy to earn passive income from real estate—without the stress of managing properties.

Best Groundfloor Investment Opportunities You Need Right Now

Groundfloor offers a variety of real estate investment options designed to fit different risk levels and financial goals. Whether you want hands-on control, automated investing, or low-risk fixed returns, these top opportunities can help you grow your wealth with real estate-backed assets.

Limited Recourse Obligations (LROs)

Groundfloor’s Limited Recourse Obligations (LROs) allow investors to fund individual real estate loans, giving them full control over their investments. Each LRO is backed by a specific real estate project, ensuring transparency, security, and predictable returns.

Pros:

✔ Investors select their own real estate-backed loans

✔ Short-term investments with high-yield potential

✔ Secured by real estate assets

Cons:

✖ Requires manual selection of loans

The Bottom Line:

Perfect for investors who want to handpick projects and build a custom real estate portfolio.

Flywheel Portfolio

For a hands-free investment experience, the Flywheel Portfolio reinvests your earnings across multiple real estate loans, ensuring consistent returns and portfolio diversification.

Pros:

✔ Automated investing with portfolio diversification

✔ Hands-off approach for passive income seekers

✔ Reinvests earnings for compounded growth

Cons:

✖ Less control over individual loan selections

The Bottom Line:

A great option for investors who prefer automation and steady returns without active management.

Groundfloor Notes

For those looking for low-risk, fixed-rate investments, Groundfloor Notes provide guaranteed returns ranging from 4% to 8% over short terms (3-12 months). These are perfect for conservative investors seeking predictability and security.

Pros:

✔ Short-term, fixed-rate returns

✔ Great alternative to bonds and savings accounts

✔ Low-risk investment backed by real estate loans

Cons:

✖ Lower returns than riskier investment options

The Bottom Line:

A great choice for conservative investors seeking steady, fixed returns.

Groundfloor IRAs

For long-term wealth building and tax benefits, Groundfloor IRAs allow investors to grow real estate investments tax-free while preparing for retirement.

Pros:

✔ Tax-deferred or tax-free growth options

✔ Ideal for long-term investors planning for retirement

✔ Backed by real estate-secured loans

Cons:

✖ Limited access to funds before retirement

The Bottom Line:

Perfect for investors who want to maximize tax advantages while earning real estate-backed returns.

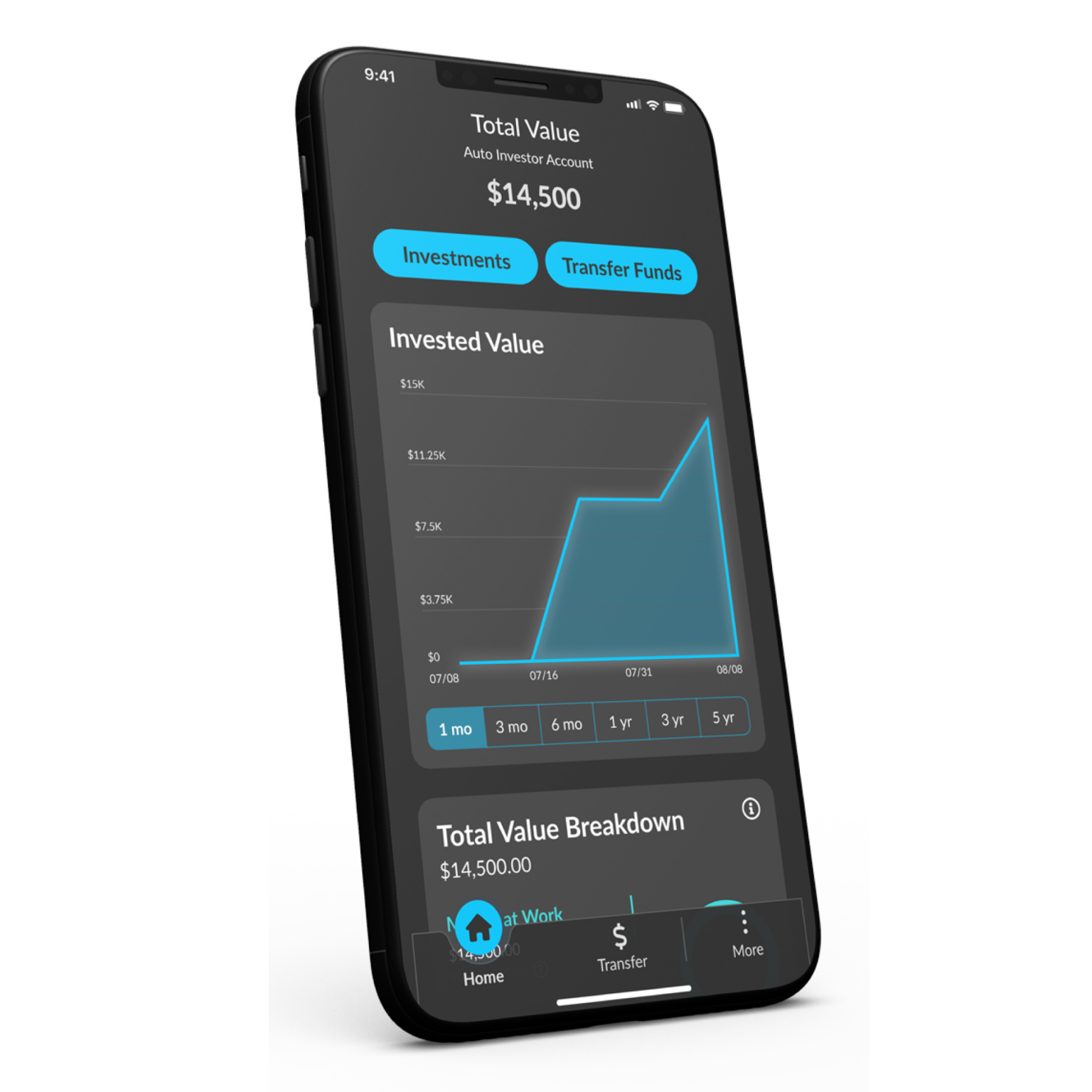

Self-Directed Auto Investing

For investors who want a fully automated real estate investment strategy, Self-Directed Auto Investing allows you to set preferences, diversify across multiple loans, and enjoy passive income without constant monitoring. Groundfloor automatically allocates your funds into high-quality, short-term real estate loans, ensuring consistent returns with minimal effort.

Pros:

✔ Hands-free investing with automated loan selection

✔ Customizable preferences for diversification

✔ Reinvests earnings for compounded growth

Cons:

✖ Less direct control over specific loan choices

The Bottom Line:

A perfect choice for investors who want a completely passive, hands-off approach to real estate investing.

Minimum $10 Investments

One of Groundfloor’s most revolutionary features is its low minimum investment requirement. With just $10, investors can start earning passive income from real estate loans—something that was previously only accessible to wealthy investors. This feature allows new investors to experiment with real estate investing while minimizing risk.

Pros:

✔ Extremely low barrier to entry ($10 minimum)

✔ Ideal for first-time investors exploring real estate opportunities

✔ Allows for high diversification with small amounts of capital

Cons:

✖ Requires multiple investments to see significant returns

The Bottom Line:

A fantastic entry point for beginners and those looking to test real estate investing without a big commitment.

The Rising Popularity of Groundfloor in Real Estate Investing

Groundfloor is changing the way people invest in real estate, making it more accessible, transparent, and profitable for everyday investors. With options like fractional investments, short-term Notes, and automated portfolios, the platform offers diverse ways to earn passive income from real estate. According to Business Insider, “Groundfloor’s innovative approach removes traditional barriers to real estate investing, allowing more individuals to build wealth through real estate-backed opportunities.”

“Groundfloor’s innovative approach removes traditional barriers to real estate investing, allowing more individuals to build wealth through real estate-backed opportunities.” — Business Insider

Beyond accessibility, Groundfloor provides investors with security and transparency. Every investment is backed by real estate assets, and the platform’s historical returns of around 10% annually make it an attractive alternative to traditional investing. As Forbes notes, “Groundfloor has redefined real estate investing by offering flexible, low-risk options for investors looking to diversify beyond stocks and bonds.”

“Groundfloor has redefined real estate investing by offering flexible, low-risk options for investors looking to diversify beyond stocks and bonds.” — Forbes

Groundfloor – Real Estate Investing for Everyone!

Gone are the days when real estate investing was only for the wealthy. With Groundfloor, anyone can invest in property-backed opportunities with as little as $10, earning passive income without the need to buy or manage properties.

Whether you’re a seasoned investor or just getting started, Groundfloor makes it easy to build wealth, diversify your portfolio, and take control of your financial future. So why wait? Start investing today and let real estate work for you!

FAQs

Q: How much do I need to start investing with Groundfloor?

A: You can start with as little as $10, making it one of the most accessible real estate investment platforms available.

Q: Is Groundfloor safe for investors?

A: Yes! Every investment is secured by real estate assets, providing an added layer of security.

Q: What are the typical returns on Groundfloor investments?

A: Groundfloor investors have historically earned around 10% annually, though returns vary based on the chosen investments.

Q: Can I automate my investments?

A: Yes! The Flywheel Portfolio automatically reinvests your earnings to maximize returns.