Shopping for the right online bank can feel like a game of hide and seek, but we’ve done the hard work for you. From high-yield savings accounts to no-fee checking options, we’ve rounded up the best features of Axos Bank to make managing your money easier—and more rewarding!

A Quick Overview:

- Best All-in-One Banking Solution – Axos ONE® Checking and Savings

- Best High-Interest Checking – Axos Rewards Checking

- Best Cash-Back Checking – Axos CashBack Checking

- Best High-Yield Savings – Axos High Yield Savings Account

- Best Hybrid Savings Option – Axos High Yield Money Market Account

- Best Fixed-Rate Investment – Axos Certificates of Deposit (CDs)

Expert Tips on Choosing the Best Online Bank

Choosing the right online bank is a crucial decision that impacts how you manage your money, access financial services, and grow your savings. With so many digital banks available, it’s important to consider factors like fees, interest rates, account features, and customer support before making a commitment. Unlike traditional banks, online banks such as Axos Bank offer higher interest rates and fewer fees, making them an attractive option for modern banking needs.

One of the first things to consider is what type of account suits your financial lifestyle. If you’re looking for an account that rewards you for everyday banking, a cashback or high-yield checking account might be ideal. Alternatively, if your goal is to grow your savings, a high-yield savings or money market account can help maximize your returns. Axos Bank, for example, offers a variety of banking products, including interest-bearing checking accounts and no-fee savings options, giving customers the flexibility they need.

Security and accessibility should also be top priorities when selecting an online bank. Look for institutions with strong encryption, fraud protection, and FDIC insurance to safeguard your deposits. Additionally, check if the bank provides mobile banking apps, ATM access, and seamless money transfers to ensure a hassle-free experience. Banks like Axos Bank are known for their secure, user-friendly platforms, giving you the convenience of banking anytime, anywhere.

The Best Online Banking Solutions from Axos

With so many digital banking options available, finding the best online bank can be overwhelming. Axos Bank has carved out a reputation as a top-tier digital banking provider, offering a wide range of financial products that cater to different needs. Whether you’re looking for a high-yield savings account, a cash-back checking option, or a flexible money market account, Axos has something to offer. Below, we break down the top banking products from Axos Bank to help you find the perfect fit for your financial goals.

Axos ONE® Checking and Savings

A seamless combination of checking and savings, the Axos ONE® account is a one-stop banking solution that offers competitive interest rates and fee-free banking. Designed for users who want simplicity and efficiency, this account allows you to earn interest on both checking and savings balances while avoiding unnecessary charges.

Pros

Earns interest on checking and savings balances

No monthly maintenance fees

Access to over 91,000 fee-free ATMs

Cons

Requires maintaining qualifying balances to maximize rewards

No physical branches for in-person banking

The Bottom Line

Axos ONE® is perfect for those who want a streamlined banking experience with high-interest rates and no hidden fees.

Axos ONE® Checking and Savings Features:

- Interest Rate: Up to 4.86% APY on savings

- Checking APY: 0.51%

- ATM Access: 91,000+ fee-free ATMs

- Monthly Fees: None

Axos Rewards Checking

For those looking to earn high interest on their checking account, Axos Rewards Checking is a great option. Offering up to 3.30% APY, this account rewards customers who meet specific criteria, such as setting up direct deposits and using their debit card frequently.

Pros

One of the highest interest rates on checking accounts

No minimum balance requirements

Unlimited domestic ATM fee reimbursements

Cons

Must meet multiple requirements to earn the highest APY

No cash deposit options

The Bottom Line

If you’re someone who frequently uses your debit card and wants to earn interest on your balance, Axos Rewards Checking is an excellent choice.

Axos Rewards Checking Features:

- Interest Rate: Up to 3.30% APY

- Minimum Balance: $0

- Monthly Fees: None

- ATM Reimbursement: Unlimited domestic ATM fee reimbursements

Axos CashBack Checking

For customers who prefer cash-back rewards over interest earnings, Axos CashBack Checking provides up to 1% cash back on signature-based debit card purchases. This account is ideal for those who frequently shop and want to get rewarded for their spending.

Pros

Earns cash back on debit card purchases

No monthly maintenance fees

No overdraft or non-sufficient funds (NSF) fees

Cons

Cash back is only available for signature-based transactions

No physical branch locations

The Bottom Line

Axos CashBack Checking is a great fit for customers who want to earn rewards on everyday purchases instead of earning interest on their balance.

Axos CashBack Checking Features:

- Cash Back: Up to 1% on eligible purchases

- Minimum Balance: $0

- Overdraft Fees: None

- ATM Access: 91,000+ fee-free ATMs

Axos High Yield Savings Account

If your goal is to grow your savings, the Axos High Yield Savings Account offers competitive interest rates without charging any monthly maintenance fees.

Pros

Competitive interest rate

No monthly maintenance fees

Low minimum deposit requirement

Cons

No ATM card included

No physical branch access

The Bottom Line

For those looking to maximize their savings with a high-yield account, Axos High Yield Savings provides an excellent solution with minimal fees.

Axos High Yield Savings Features:

- Interest Rate: Competitive APY

- Minimum Deposit: $250

- Monthly Fees: None

High Yield Money Market Account

A hybrid between a savings and checking account, the Axos High Yield Money Market Account provides competitive interest rates while offering check-writing capabilities.

Pros

Higher interest rates than traditional savings accounts

Check-writing privileges

No monthly maintenance fees

Cons

Minimum deposit required to open an account

Limited transactions per month

The Bottom Line

If you want the flexibility of a checking account with the benefits of a high-yield savings account, this option is worth considering.

Axos High Yield Money Market Features:

- Interest Rate: Competitive APY

- Minimum Deposit: $1,000

- Monthly Fees: None

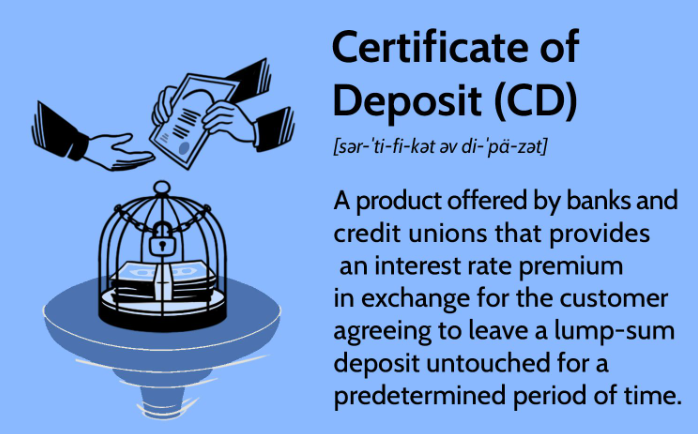

Axos Certificates of Deposit (CDs)

For those looking for a secure, fixed-rate investment, Axos CDs provide guaranteed returns with terms ranging from 3 to 60 months.

Pros

Fixed interest rates ensure guaranteed returns

No setup or maintenance fees

Multiple term options available

Cons

Early withdrawal penalties apply

Minimum deposit required

The Bottom Line

If you’re looking for a secure way to grow your savings over a set period, Axos CDs provide stability and strong returns.

Axos Certificate of Deposit Features:

- Terms: 3 to 60 months

- Interest Rate: Competitive APY

- Minimum Deposit: $1,000

- Early Withdrawal Penalty: Yes

The Enduring Appeal of Axos Bank’s Digital Banking Solutions

Axos Bank has established itself as a significant player in the digital banking landscape, offering a range of products that cater to both personal and business banking needs. Its commitment to innovation and customer-centric services has garnered attention from various financial analysts and publications. According to Business Insider,

Axos Bank is an online bank that offers a high-yield savings account, money market account, CDs, and a variety of checking accounts.

This diverse portfolio allows customers to tailor their banking experience to their specific financial goals.Business Insider

The bank’s emphasis on providing competitive rates and low fees has also been a focal point of its appeal. Forbes Advisor notes that

Axos Bank personal banking customers can reach support through its mobile app, by sending a secure message through their online accounts or calling Axos at 844-999-2967, 24 hours a day, seven days a week.

This accessibility underscores Axos Bank’s dedication to customer service, ensuring that clients have support whenever they need it

Final Thoughts: Banking Made Smarter with Axos

If banking had a VIP section, Axos Bank would be sitting front and center—offering high-yield savings, fee-free checking, and cash-back perks that make traditional banks look, well… a little outdated. Whether you’re saving for a dream vacation, managing daily expenses, or just want a bank that doesn’t nickel and dime you, Axos has something for everyone. Plus, with 24/7 access to your money and a slick mobile app, who even needs a branch anymore?

So, if you’re tired of banks that still act like it’s the 90s—Axos Bank might just be the upgrade your finances deserve. Get ready to bank smarter, not harder!

FAQs

1. Is Axos Bank safe to use?

Yes! Axos Bank is FDIC insured, meaning your money is protected up to $250,000 per depositor. They also use advanced security measures to keep your account safe.

2. Does Axos Bank charge monthly fees?

Nope! Most Axos accounts come with zero monthly maintenance fees, so you can keep more of your money where it belongs—in your account.

3. How does Axos Bank compare to traditional banks?

Unlike traditional banks, Axos operates 100% online, which means higher interest rates, fewer fees, and better perks—without the hassle of branch visits.

4. Can I deposit cash with Axos Bank?

Yes, but it requires a little extra effort. You can deposit cash at participating ATMs or through services like Green Dot at select retailers.